Introductions

The COVID-19 pandemic has caused significant financial impact on the airline industry. So which one of the major airlines most at-risk for bankruptcy? In the past three months major airlines stocks plunged with a 30-60% decrease in value. As shutdown comes to a close, investors look toward major airline companies for a once in a lifetime opportunity; to buy in to airlines royalites such as Delta (NYSE:DAL), Southwest Airlines (NYSE:LUV), American Airlines (NASDAQ: AAL), and United Airlines (NASDAQ:UAL). Delta is america’s largest airline, will it lead the pack?

Note: All of the graphs and charts are interactive! Use your cursor to play around with the visuals.

Example

Who is Delta Competitors?

Lets us look at the US Airline marketshare.

Looking at the current US airline industry, the main competitors for Delta are Southwest Airlines, United Airlines, and American Airlines. All of these corporations have a similar sized peice of the marketshare pie ranging from 15-18%. For an expanded comparision, let’s not forget about the little guys, I have included the smaller corporations as well.

How does Delta compares?

Taking a look at airline companies matrics for comparision.

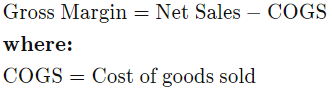

Gross margin is the sales revenue a company retains after incurring the direct costs associated with producing the goods it sells, and the services it provides.

Summary of airlines Gross Margins

Among its competitors Delta airlines fits right in the middle of the pack in Gross Margin. Over the last 10 quarters all of the airlines were pretty consistent trending losses at about 5% the first quarter. Looking at the graph below you can see that American Airlines suffered the biggest loss at 10% of the gross margin.

Profit margin is the net percentage of profit after all of the expenses are taken in to account. When calculating net profit, bussinesses subtract the cost of goods sold as well as, product distribution, sales rep wages, in addition to other operating expenses and taxes.

Summary of airlines Profit Margins

Among its competitors Delta airlines is toward the top end of the pack when it comes to Net Profit Margin. Over the last 10 quarters prior to the most recent, Delta showed a slow and consistent growth. When compared to the leader of the pack Southwest Airlines is on a small decline, where American Airlines and United Airlines are at the bottom of the pack. Its safe to say all of the airline companies suffered a net loss of profit in the first quarter of 2020. This was the outcome of the early stage of the COVID-19 pandemic. Despite this losse both of the leaders; Southwest and Delta only suffered a net loss of profit of less than 10%, where United and American Airlines exceeded a 20% loss of Net Profit.

Market Captitalization is a company’s worth, or its total market value. This number is represented by the company’s stock price multiplied by the number of shares outstanding, or all the shares of a company stock that is purchased and held by the company’s investors.

Summary of airlines Market Cap.

Among its competitors, Delta Airlines leads the pack and is consistently edging out its main competitor Southwest. Ever since the first quarter of 2018 Delta has surpassed Southwest Airlines. The most recent quarter shows a significant market cap reduction, and Southwest Airines is leading slightly. I believe this is a sign that Delta is more “oversold” compared to its competitors and would be a better bargain than Southwest. United Airlines sits at the middle of the pack in market cap for the past 10 quarters and fell toward the bottom of the pack towards American airlines this recent quarter.

P/E Ratio is a measure of the relationship between a company’s stock price and it’s earning per share of stocks. Generally a high P/E ratio indicates that investors expect higher earning, but does not mean that it is a better investment. A high P/E ratio could indicate an “overvalued” stock and a low P/E could tell us the opposite.

Summary of airlines P/E ratio

Among it’s competitors Delta Airlines tend to stabilize at a certain P/E ratio. Stocks that have a consistent P/E ratio are less unpredictable and won’t change too much with volatility. Delta, Southwest, and United all have a pretty consistent trend when it comes to P/E ratio. Southwest shows a slow increase of P/E ratio overtime. Based on P/E ratio perspective alone Southwest Airlines is the best set against the airline’s competitors. What is interesting is that American Airlines have a very volitile P/E ratio, showing an extremely high peak at a P/E ratio of 34 and at the bottom end at a P/E ratio of -6.

Note: AAL D/E ratio is very erratic compared to its competitors and skewing the charts. I suggest using the legend and click on the AAL bar and AAL lines.

Debt to Equity evaluates a company’s financial leverage. D/E ratio is calculated by a company’s Total Liability (TL) divided by the Total Shareholder’s Equity (TSE). TL usually consists of loan amounts, whereas the TSE is the TL subtracted by all of a company’s assets; such as material, income,…etc. In summary, the higher the D/E ratio of a corporation equates to the higher the risk of investing in that corporation.

Summary of airlines D/E ratio.

Over a period of time Delta, United, and Southwest have maintained a consistent D/E ratio. Delta’s D/E ratio ranges between 3.5 to 3.8, United airlines ranges between 3.5 to 4.6, and Southwest’s has a range of 1.6 to 1.7. When looking at the D/E ranges, Southwest appears to be the best company in terms of leveraged health. Also notice that American Airlines has a huge negative D/E ratio. This means that American Airline’s liabilities exceeds its assets, throwing their D/E ratio into a very volatile range of 381 to -2817. In short, American Airlines has consistently had a negative D/E ratio, operating in very risky territory.

Free Cash Flow is the amount of cash that is leftover after a company pays off it’s expenses and capital expenditure. Free cash flow or FCF helps to measure a company’s efficiency at generating cash. A high FCF can be used to pay investors dividends, expand operations or deleverage, paying off debt. A high and increasing FCF is a good sign of recovery.

Summary of airlines FCF

Airline companies as a whole follow a very cyclical pattern of FCF. These cyclical patterns of FCF tend to bottom out around the winter months and peak during the summer months. The COVID-19 pandemic greatly affected these cyclical patterns, causing the rebound of the airline’s FCF to not be as apparent because most businesses were and are negatively affected by the pandemic.

Conclusions

In my opinion based on the data, Delta Airlines and Southwest Airlines are two companies I would invest in for long-term purposes. They both lead the pack in the fundamental stock matrics. Even though I first believed that Delta would be the best airline stock to invest in, I now admit that Southwest Airlines has great potential.

DISCLAIMERS

Sasana Kongjareon, the author of this post strongly encourages use of this information for educational purposes only and should not be relied upon as a basis for any investment decisions. The author maintains no liability as to however the reader should use the information within.